Federal Reserve chairman Jerome Powell confirmed last week that the central bank’s long-awaited pivot is just around the corner. But is this actually bullish for Bitcoin?

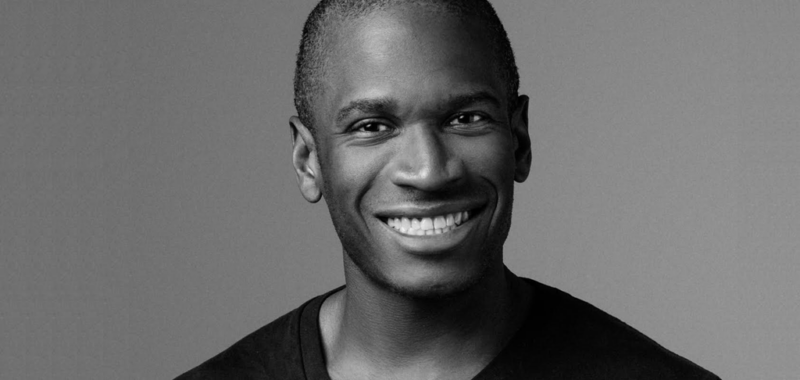

Conventional wisdom says yes, but BitMEX co-founder Arthur Hayes—a near perennial Bitcoin bull—says it’s more complicated than that.

“We are forgetting that these future anticipated rate cuts by the Fed, Bank of England, and European Central Bank reduce the interest rate differential between these currencies and the yen,” wrote Hayes in a Tuesday essay.

In Hayes’s view, the market experienced a “sugar high” on Friday when Powell confirmed that “the time has come” to start cutting interest rates, as the balance of risks between hot inflation and potential recession was beginning to tilt toward the latter.

On one hand, cheaper money lets investors borrow more easily to speculate on investments perceived to be more risky, including stocks and crypto. This phenomenon helped Bitcoin surge 15X between March 2020 and April 2021, for example.

On the other, weakening the dollar alongside the euro and British pound would effectively strengthen the Japanese yen and cause the “yen carry trade” to unwind and crater global markets. The yen carry trade is when investors borrow cheaply from the Bank of Japan to invest in global assets denominated in stronger currencies, earning as those assets appreciate with seemingly minimal risk.

A version of this “unwind” already occurred in early August as the Bank of Japan hiked rates for the first time in seventeen years to 0.25%. Bitcoin briefly dipped below $50,000 at the time, and Hayes told followers to “buy the fucking dip” as the central bank quickly promised not to keep hiking amid financial market instability.

The popular trader suspects a similar response from the U.S. should markets experience another Japan-related emergency. Specifically, he believes the Fed will begin expanding its balance sheet to flood the economy with a greater money supply—a form of “real food” with longer-term consequences for markets.

Altogether, the trading setup could not be better for crypto, he believes, regardless of whether there is a short-term recession.

“They will ramp up the money printer and dramatically increase the money supply,” he said. “But for assets in finite supply like Bitcoin, it will provide a trip at lightspeed 2 Da Moon!”

Edited by Ryan Ozawa.