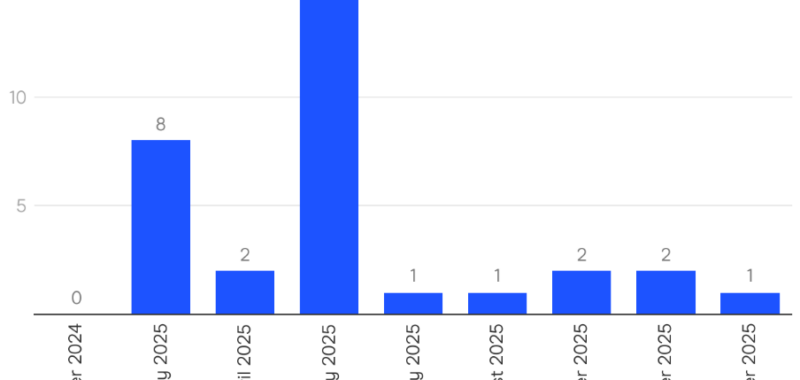

A survey of 40 leading economists and experts by Finder shows nearly half (49 per cent) expect the first rate cut to come in May next year, with no changes expected to the current cash rate of 4.35 per cent before then.

The survey reveals a growing consensus that while rate relief is coming, the RBA will maintain its cautious approach to monetary policy well into 2025.

AMP’s Shane Oliver said the evolving economic conditions are influencing the timing.

“With inflation trending down and weaker than expected growth we think the RBA should cut earlier and there is still a high chance of a February cut,” Dr Oliver said.

Mala Raghavan from University of Tasmania said the cash rate is anticipated to decrease in May, but it will only come down by 25 basis points.

“The fall in cash rate is unlikely to significantly relieve the pressure on mortgage holders,” Dr Raghavan said.

“By being mindful of their financial decisions, households can better navigate the economic landscape ahead.”

Craig Emerson from Emerson Economics said the reserve bank’s approach is a sound one.

“The RBA is displaying great conservatism in its monetary policy settings, its public statements suggesting it will need to be highly confident that inflation will not rise again before it considers any cash rate reduction,” Mr Emerson said.

The majority of experts (58 per cent) believe Australians will be in a better financial position in 2025, despite ongoing challenges.

Graham Cooke, head of consumer research at Finder, said there were still plenty of pressures on households.

“The cost-of-living crisis continues to place significant pressure on households,” Mr Cooke said.

“Young Australians—particularly those renting, paying off a mortgage, or raising children—are feeling the strain most acutely.”

Leanne Pilkington from Laing+Simmons said more needs to be done to address the underlying causes.

“Major factors like the high cost of living and the housing crisis are entrenched and require long-term solutions,” Ms Pilkington said.