BlackRock’s iShares Bitcoin Trust (IBIT) has set a new record for its largest single daily inflow since it was listed in January as demand for U.S. spot Bitcoin exchange-traded funds experience surging trading activity amid heightened investor interest.

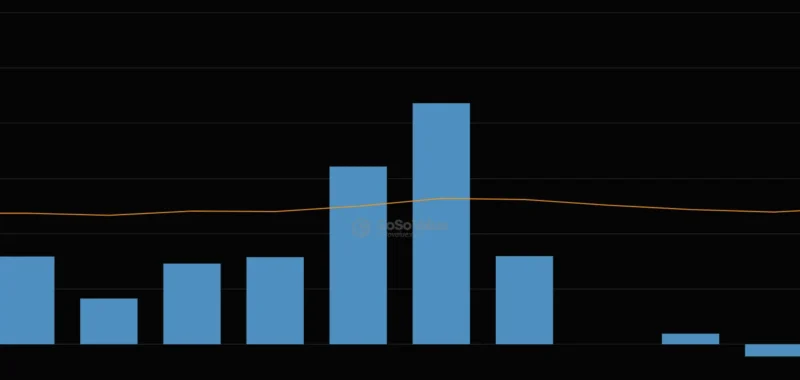

IBIT pulled in a total of $1.12 billion on Thursday, beating out its prior October 30 record of $872 million, data from SoSoValue shows.

The fund, which has emerged as a dominant force among its 10 other rivals, has a net asset value of $34.2 billion, bolstered by Bitcoin’s heightened value.

“We’re in a goldilocks scenario right now of monetary easing, political certainty, and robust US data,” Pav Hundal, lead market analyst at crypto exchange Swyftx, told Decrypt. “Capital is everywhere, and right now, it’s flooding into the ETFs at an extraordinary velocity.”

Investor interest for the world’s largest crypto is at an all-time high, which has helped fuel continual record-setting heights for the asset, above $76,870, amid surging activity among altcoins and meme coins.

“The ETFs are accumulating Bitcoin faster than it can be created by a factor of two to one,” Hundal added. “Sooner or later, this will tip across into a broad-based crypto rally. Probably sooner.”

It comes as IBIT posted a record $4 billion in trading volume on Wednesday, vastly exceeding its nearest rival, Fidelity, after President-elect Donald Trump secured a second term as the 47th president of the United States.

Trump’s Whitehouse win is viewed by many in the industry as a boon for digital assets. He has promised to protect crypto mining interests, establish a Bitcoin reserve, and usher in favorable policy.

The ascent of IBIT as a top Bitcoin ETF comes amid shifting sentiment over investments in institutionalized crypto. The fund has maintained steady inflows since inception, while competitor Grayscale’s GBTC—the second largest by net assets at 16.8 billion—has faced negative outflows due to its high fees.

BlackRock charges a 0.25% fee, waived until January, while GBTC charges significantly higher at 1.5%. Fidelity’s FBTC, meanwhile, also charges 0.25%, though its waiver ended in July.

Edited by Sebastian Sinclair